What is a Property Tax Delinquency?

Imagine one morning you are sitting at the table, thumbing through your mail while sipping on a hot cup of wonderfully fresh coffee. Spring is in the air, and you have plenty on your plate as you begin to make plans for getting your house ready for the summer. Then you see that dreaded piece of mail, reminding you of your annual obligation as a responsible homeowner: It’s time to pay your property taxes.

In Indiana, property taxes are levied to support the budget of state and local governments. This means that every year, the state requires you to pay a tax based on the value of the property you own. This is called an ad valorem tax. To determine the value of the property you own, your property is assessed by the state. Once the value of your home is determined, the state sends out a tax bill based on this value multiplied by the tax rate for your locale. This process is governed by Indiana Code 6-1.1-4. Under current law, properties are assessed every 4 years.

The state of Indiana will then mail you a tax bill every year, and you pay the taxes in arrears. This means that on your tax bill you should see, "2019 Payable 2020." This means you are billed for taxes assessed last year, but they are due in 2020.

If you didn't remember or weren't able to pay your taxes in 2019, these also get rolled into your 2020 taxes. This is what is known as a "tax delinquency" and it can cause some serious issues for your home ownership.

What Happens to Homes with Tax Delinquencies in Indiana?

When you have a tax delinquency, you have an opportunity to repay your past due amount on your May taxes. If this is missed however, fees start piling on, and worse you can start down a path of losing possession of your home. The short story is that properties with back taxes are offered for sale every year at a "Tax Sale." While you do have the right to "redeem" your property, it will be with additional penalties and interest owed to the highest bidder.

The Tax Sale

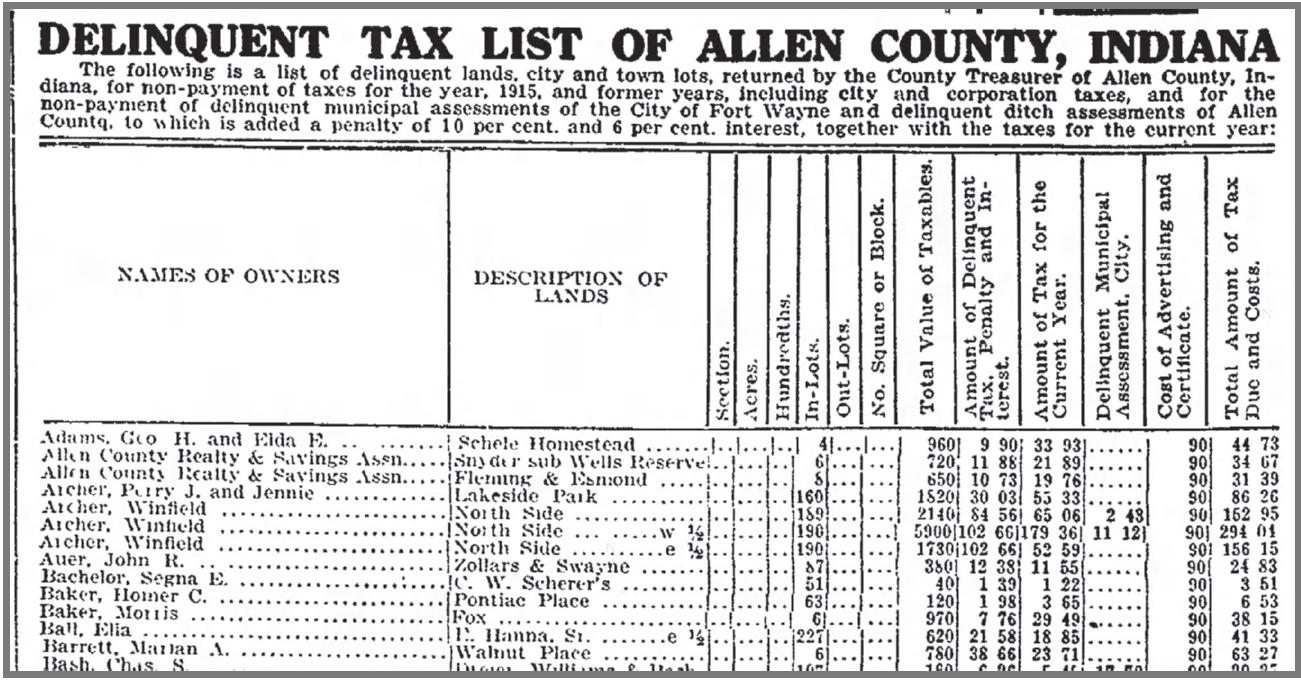

Every year, under Indiana Code 6.1.1.24 the county treasurer provides a list of unpaid taxes to the county auditor. The auditor then scrubs the list of "vacant" properties. These properties are sold with no right of redemption. This is important because if you have a home on which you owe taxes, and it is deemed to be vacant you can lose this property for the amount you owe in taxes! Can you imagine that? Losing a property for $3,000? Yet, it can happen.

If your property is occupied, you have a little bit more time to solve your tax problem, but not an incredibly long time. You have 12 months from the date of the tax sale to "redeem" your property. The redemption is essentially paying the county the following fees:

110% of the amount of the delinquent property taxes, delinquent special assessments, and current year property tax installment and the costs of the sale if the property is redeemed not more than six months after the date of the sale;

115% of the amount of the delinquent property taxes, delinquent special assessments, the and current year property tax installment and the costs of the sale if the property is redeemed more than six months but not more than one year after the date of the sale;

5% per annum on the amount that the purchase price exceeds the delinquent property taxes and special assessments;

5% per annum on any subsequent taxes or special assessments due and paid in the following year by the buyer.

5% per annum on any other taxes or special assessments paid by the Auditor from the surplus funds.

An Example:

Let's say you own a home in Fort Wayne, Indiana assessed at $55,000. Let's further imagine that it isn't your main residence, but instead is a home you inherited from a loved one. You decided to rent it out but you didn't factor in some of the ownership costs when setting your rent amount. After a couple of years of owning the property, you aren't able to cover your Fall tax payment which at the current 2% tax cap would be $550.

Come Spring, you get a notice of your current year's installment, plus last year's delinquency and associated fees. Indiana assesses a 5% late fee if you pay your tax before its 30 days late, and if you don't owe any back taxes. Because you missed your delinquency extended beyond 30 days, you will get tagged with a 10% fee.

Now you owe your delinquency plus fees in addition to your Spring installment in early May. In this example, that is a total of $1,155. Still having a hard time getting the cash to pay it off, you miss your spring installment as well. This gets another 10% fee added to it and now your total liability is $1,270.50

If this goes to the Allen County Tax Sale, the minimum Bid becomes your delinquent taxes, plus the fall installment, and an additional auction fee of $545. In this case, that is your previously owed amounts, plus pending $550 fall installment, or $2365.50. After bidding at the auction, a limited lien is awarded to the highest bidder who won it for $2,750. At this point, you have 12 months to redeem your property.

At this point, you will have to pay interest to the individual who holds the limited lien so we can't give you the exact amount, but we can say if you were to redeem this on the last day you could, you would owe the following:

115% of the minimum bid required of $2365.50 totaling $2720.33

5% per year of the extra amount to win the bid ($2750-$2365.50=384.50) totaling $19.23

5% per year of the taxes paid by the highest bidder (he/she would have paid your spring taxes on this property) totaling $13.75

Plus the taxes paid, along with any attorney fees and special assessments... In this case we will just assume the house had the same taxes and no other fees. Totaling $550

Grand total to redeem the property: $4664.50

What Happens if I Can't Redeem the Property?

Unfortunately, if you are unable to pay this amount to redeem the property, after 3 months the highest bidder can petition for a tax title deed and take possession of the house. If the petition is granted, which it most likely will be, the newly deeded owner takes possession of the property and you are no longer in control of that house. It can be sad and disappointing to see people lose homes over such small amounts of money, but these types of scenarios do occur.

Do I Have Options?

We can think of a few options for you if you want to keep the property and pay your debts. Here are a few!

Pay the taxes immediately: You will save the most money and maintain the most control of your property if you pay the taxes immediately as they are due. This is the option we recommend.

Refinance the home: If you have equity in your home and can't afford the short-term cost of taxes, but you can see yourself being able to afford them in the future, borrowing money against the equity you have, or performing a "cash-out refinance" on the property may give you the cash you need in the short term to retain ownership of the home.

Sell to a professional home buyer: You might determine that you no longer want to own the home or that even after taking equity out of the home you won't be able to keep up with the tax liability the property generates. At this point, it may make sense to sell the home on the open market or to a cash buyer (especially if there are back taxes). Professional home buyers like Olive Tree Properties can help you assess your situation and determine if a sale is right for you. Olive Tree Properties may be able to help you pay off your delinquent taxes, redeem your property, and put money in your pocket.

Still Need Some Help?

Need some help sorting all of this out? Olive Tree Properties would love to talk with you more about your situation and see how you can keep your home, or if selling your home may be right for you. You can contact us by phone, or email, or you can schedule a call here!